Building credit is one of those long-term financial moves that doesn’t always feel urgent—until it suddenly is. Whether you’re looking to upgrade your lifestyle, access better financial tools, or simply boost your overall financial reputation, a strong credit profile can make a real difference. But the way you build that credit matters just as much as the result.

Too often, people are tempted by shortcuts. Quick approvals, no questions asked, and flashy promises may sound appealing, but they come with a catch. Unregulated financial services don’t just lack transparency—they lack accountability. And building credit through them rarely builds anything stable. In fact, it can have the opposite effect, trapping users in cycles of hidden fees and unfair practices that hurt more than help.

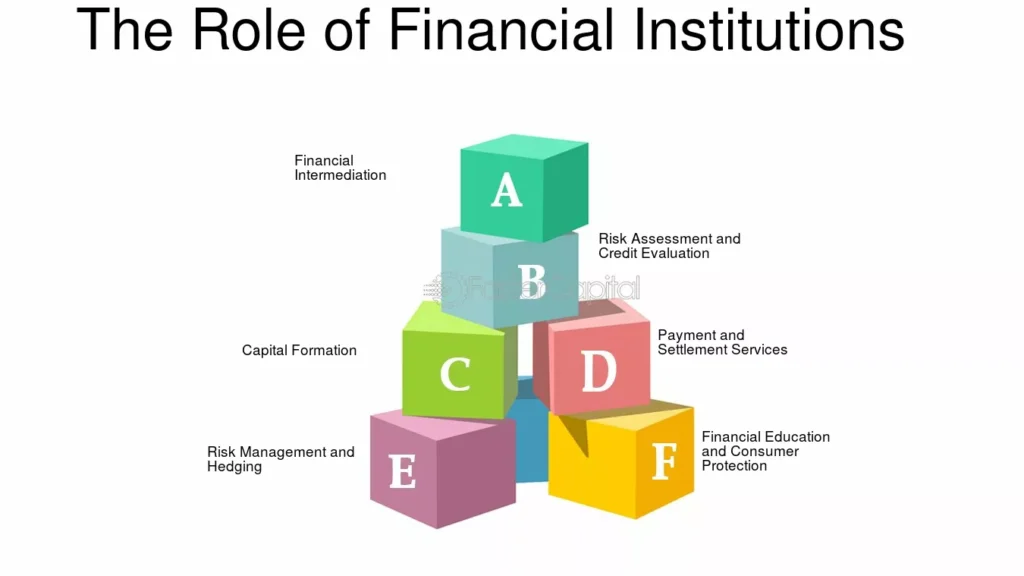

This is where legal financial institutions stand out. They’re built to help people grow, not just get by. With proper regulatory systems in place, these institutions offer structured and traceable services that contribute to actual credit building. Every financial step you take—whether it’s using a payment service, paying on time, or managing your account—is tracked and reflected in a way that supports your long-term financial standing.

The difference is not just in the process, but in the protection. Legal financial institutions are required to follow ethical practices. That means your payments are reported accurately, your data is handled responsibly, and your financial actions are contributing to something real. You’re not just getting access to services—you’re getting a chance to improve your future.

Another key benefit is clarity. With legal institutions, there’s no confusion around terms or expectations. You know what you’re signing up for. That kind of transparency builds trust, which is the foundation of any meaningful financial relationship. It also helps people learn. Over time, users become more aware of how credit works, how it’s tracked, and how to improve it—knowledge that simply doesn’t come from using unreliable services.

And let’s not forget about support. When you work with a regulated institution, there’s always someone to talk to. If something seems off, you can ask questions. If something goes wrong, there are clear paths to resolution. That kind of reliability is a game changer when you’re trying to build credit without unnecessary risk or stress.

In the end, building credit is not just about getting access to future benefits. It’s about laying a foundation of trust, responsibility, and growth. And the safest, most effective way to do that is through legal financial institutions that are built for the long run—not just quick wins.

So if you’re serious about building credit the right way, start with a platform that values your progress, protects your data, and puts your future first. The right foundation leads to stronger opportunities—and the right institution makes sure that foundation is solid.